Fixed cash back credit cards certainly have their benefits — Especially

With the right card, you can earn 2% (or more) cash back on all your purchases with no annual fee. And with no bonus categories to track, you never have to wonder if you're using your loyalty card the “right way.”

However, there are ways to increase your flat rewards. -Rate cashback card. In most cases, you'll need to shop strategically and be willing to take a few extra steps.

6 ways to maximize rewards with any cashback credit card

Contents

1. Bill payment Using Your Card For

If you're getting rewards with a flat-rate cash back credit card, the more you charge, the more cash back you'll automatically earn. Not all invoices are rewardable (depending on invoice type), but it makes sense to look for new invoices that can be paid with a credit card.

Aside from basic expenses like groceries, gas, and meals, see if you can pay other bills with your credit. For example, you can use your card to pay for insurance, utilities, mortgage payments, rent, subscriptions, and even day care.

2.Double with cash back portal

Any time you pay for something online with your credit card, you also have the opportunity to earn rewards on cashback sites. Earn extra cash back when you click on websites before you shop at stores like Priceline.com. Remember that the cash back earned on this portal is in addition to the cash back earned on credit cards.

Other cashback apps and portals include TopCashBack, Cashback Monitor and Ibotta.

3. Use your card issuer's shopping portal

Some card issuers also have their own shopping portals where you can earn extra cashback.

For example, if you have Chase Freedom Flex℠ or Chase Freedom Unlimited®*, you can click Shop through Chase. Portal before you shop to earn more cashback on all your purchases. The stores on the Chase shopping portal vary, but they often include options like Walmart, Sephora, Best Buy, and Macy's.

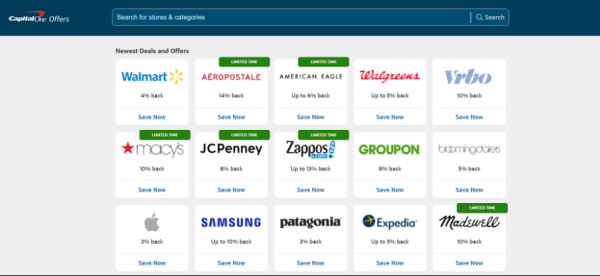

Meanwhile, Barclaycard has its own shopping portal called RewardsBoost and Capital One has Capital One Shopping. .

4. Leverage publisher-specific offers

If you have an American Express, Chase or Capital One credit card, you can also check out additional cash back offers. Each of these card issuers has additional programs (Amex Offers, Chase Offers, Capital One Offers) that allow you to receive additional cash back from select retailers.

For example, with Capital One Offers, individuals with cash back credit cards such as the Capital One Quiksilver Cash Rewards Credit Card and the Capital One Quiksilver One Cash Rewards Credit Card earn more cash back at certain retailers. can. To do this, simply log into your Capital One account and go to the shopping portal. From there, click Save Now to be taken to the retailer's site to shop and earn extra rewards at checkout.

Cash Back Rates vary by store. We usually limit the amount of additional cashback you can earn. In any case, all of these special offers are on top of the cash back you normally get with your credit card. It's easy to add to the card and use it, so please try it if you can.

5. Don't Carry Debt on Your Account

On the other hand, it's hard to imagine how you can maximize your cashback without looking at your balance and monthly payments. Interest credit card charges can cost a lot more than you get with cash back.

If your goal is to earn as much cashback as possible, you should avoid debt and avoid carrying around balances. You must bill, track your spending through each billing period, and faithfully pay your entire balance on time each month.

This part is not so exciting. It's like getting cashback, but it's much more important not to go into debt.

6.Combine with rotating bonus category cards

Finally, you can consider pairing your flat rate card with a card that offers more rewards in the bonus category, but only if you really need it. Earning rewards can be more complicated with this strategy, but it can help you earn higher cashback rates for your spending.

Don't overcomplicate your life. To pair a card without it, you'll need to choose a different rewards credit card…together with your flat rate card. Specifically, you should choose a card that offers boosted rewards in your highest spending categories, or a 5% rotating bonus category card that offers high cash back in new categories every quarter.

Everyday Essentials

If you cook a fair amount at home, you probably benefit from a credit card that rewards grocery purchases. One of the best credit cards for groceries is American Express' Blue Cash Everyday® Card. It offers cardholders 3% cash back (up to $6,000 annually and 1% thereafter) at US supermarkets with no annual fee. Also, he offers 3% back on purchases at US gas stations and US online retailers (with the same $6,000 limit per category). With such a practical bonus category, Blue Cash Everyday is popular with families and bargain seekers.

Another card with a wide range of attractive bonus categories is the Chase Freedom Flex highlighted above. This card does not charge an annual fee, but you can earn 5% cash back on quarterly activated bonus category purchases (up to $1,500 on purchases, then 1% thereafter). Bonus categories are announced quarterly, making it difficult to predict value, but have historically included useful categories such as Amazon.com, grocery stores, gas stations, and Walmart. Chase Freedom Flex also offers 5% cashback on Lyft rides (through March 2025) and 3% cashback on dining (including restaurants, takeout and eligible delivery services) and drugstore purchases will be

Dining

If you spend a lot of money on food and entertainment, consider the Capital One Savor Cash Rewards credit card*. A 4% cash back rate applies to these purchases (and some streaming services).

Another of the best credit cards for restaurants is the Citi Custom Cash℠ card. It offers 5% cash back on your top eligible spend categories (up to $500 per billing cycle, then 1% thereafter). One of these categories is restaurants, so foodies should make this a staple card for restaurants.

There are many options to consider, all with different features and profitability. If your goal is to find a few cards to pair with for the best rewards, compare all the best cash back credit cards on the market today.

Conclusion

There are many reasons to choose a flat rate cash back credit card, including if you don't want to juggle multiple cards. After all, with a flat rate card, you earn a higher than average reward rate on all your purchases and charges.At the same time, they also help simplify your life and finances.

You can earn as much cashback as possible, even if it means finding a few more bills that you can easily pay with your rewards credit card. By clicking into shopping portals, taking advantage of special offers from card issuers, and combining flat rate cards with bonus category cards, you can potentially earn hundreds of dollars in additional cash back each year.

*Information regarding the Chase Freedom Unlimited® and Capital One Savor Cash Rewards credit cards is independently collected by warnow.biz. Card details are not verified or approved by the card issuer.